SOLAR INCENTIVES

Don’t forget your money savings from solar incentives! You’ve earned it.

More Ways to Get the Most of Your Solar Investment

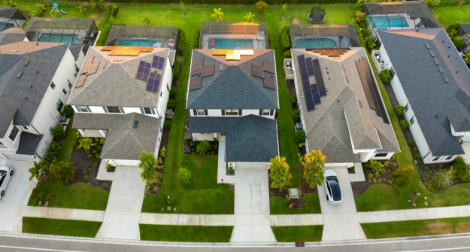

- Increased Home Value – Home buyers in Florida love pre-installed solar panels and are willing to pay more.

- Peak Energy Efficiency – Solar panels bring in the most energy savings compared to all other options.

- Solar Incentives – There are plenty of credits, rebates, deductions, and other incentives to help compensate for the cost of going solar.

Top Solar Incentives In Florida

Get to know what you may qualify for so you can bring in maximum savings on your new solar panels!

Home Solar System State Sales Tax Exemption

Solar panels are typically subject to sales tax just like any other product. The Home Solar System State Sales Tax Exemption eliminates the cost of sales tax on new home solar installation for savings of around 6%.

Florida Solar System Property Tax Exemption

New solar panels boost your home’s value, thus increasing your property tax. With Florida’s Property Tax Abatement for Renewable Energy Property incentive, you won’t see a raise in your property taxes after going solar.

Residential Clean Energy Tax Credit

Some Florida locations qualify for the federal Residential Clean Energy Tax Credit which lowers the cost of your new solar panel installation by 30%!

Florida Net Metering

Major utility companies in Florida allow net metering which earns you credit when you send excess solar energy to the public power grid.

How Do Solar Incentives Work? FAQs

How do I claim my solar tax credits?

File IRS Form 5695 with your tax return.

What do I need to claim my solar tax credits?

You will be asked to provide the cost of your solar panel system (products, materials, and labor included) and either proof of purchase or certification from the manufacturer for your qualifying solar panels.

Do I need to own my home to receive solar tax credits?

Yes, you must own the home on which your solar panels were installed.

Can I still receive solar tax credits if I sell my home?

Yes, you can claim solar tax credits even if you install your solar panels during the same year you sell your home.

Do I qualify for solar tax credits if I only lease my solar panels?

No, you must own your solar panel system in order to obtain credit for them.

Can I receive solar tax credits for solar battery storage systems?

Yes, federal energy tax credits count towards a variety of energy-saving products including solar battery storage.